In part 1, Aura's founder, Hayden, explained that while the prediction market sector exploded in 2025 with platforms like Kalshi and Polymarket nearing $60 billion in volume, this success is paradoxical. The boom is happening on centralized, corporate platforms, which undermines the core Web3 ethos. This centralization introduces a "Pyrrhic victory" by creating a single point of failure, regulatory fragility, and an extractionary model where users are "renters." In Part 2, he will set out his vision for the future of prediction markets…

The solution is to bring prediction markets back to their Web3 roots.

The next generation of prediction markets should combine the scale and usability proven by Kalshi, Polymarket, and others, with the decentralized, trust-minimized principles that motivated the first crypto prediction platforms.

This is exactly what we’re building with Aura; an open, community-governed prediction market protocol designed to fix the weaknesses of the centralized model. Let me explain further.

Trustless, Community Led Resolution

Aura has no single arbiter deciding outcomes or what markets are allowed. Instead, market resolution is handled through a decentralized community process.

When a market’s outcome is ready to be determined, anyone can propose the result by posting a bond (this disincentivizes dishonest outcome proposals). If the outcome is contested, it escalates to a community vote among $AURA stakers, who collectively decide the truth. Voters who are in the majority (i.e. vote correctly according to reality) earn a share of that market's fees.

This system creates a neutral, tamper-proof oracle governed by users, not by Aura or any single party. There is no equivalent single point of failure, and no company that can unilaterally censor a market or manipulate an outcome.

The integrity of markets is protected by the economic incentives of a distributed community, ensuring censorship resistance and reliability even under contentious circumstances. In short, trust is placed in transparent code and crowd consensus, not in corporate middlemen.

Community Ownership via $AURA

In Aura’s model, users are owners.

The platform’s native token, $AURA, isn’t just a speculative asset, it represents stake and governance in the network. Participants who hold and stake $AURA gain the right to create markets and to vote on governance decisions and dispute resolutions.

Importantly, Aura shares the value generated by the platform back with the community. Every time a trade occurs, a small fee is collected. Instead of enriching a corporation, those fees are recycled to reward the users who make the system run. Market creators earn a portion of the trading fees in the markets they created (from 1-30% depending on their tier).

Traders, of course, earn profits for being correct, as is typical of prediction markets. Resolution voters also earn fees for correctly adjudicating outcomes and keeping the oracle honest. Referrers who bring in new users earn a cut of their referrals’ trading fees.

In other words, whether or not you’re a big bettor, you can earn by contributing to the ecosystem, by curating markets, securing honest outcomes, or growing the user base. All of this is automated by smart contracts. The effect is to turn the platform into a community co-op rather than a traditional company.

When you trade on Aura, you’re not just paying a fee to some distant operator, you’re paying into a system that pays you back and gives you a voice. This ownership model aligns incentives at every level. Users want to grow the network because they directly benefit from its success, and bad behavior is discouraged because it's against the collective interest.

User Created Markets and Organic Growth

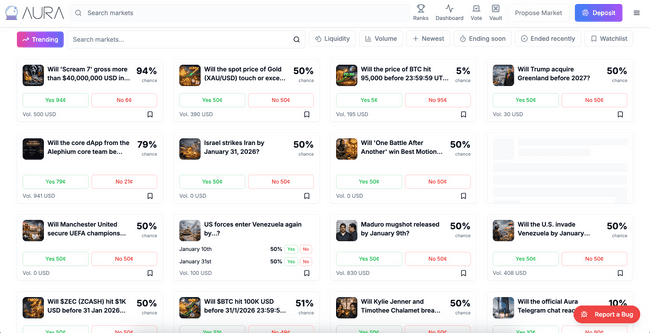

One of the most exciting advantages of decentralization is the freedom to create any market the community wants, unleashing the long tail of content.

Centralized platforms thus far have kept a tight leash on what markets list, partly due to regulatory limits, partly due to paternalistic curation. This stifles the natural virality that prediction markets can have. Aura flips that model. Any user who stakes a modest amount of $AURA can propose new markets on any question or event imaginable.

The community of token holders then votes to approve or reject these proposals, ensuring that only well defined, credible markets go live. The key difference is who generates the ideas. On Aura, the community drives the content. If there’s a niche topic with passionate interest, Aura users can bring it to life as a market.

Creators are incentivized to promote their markets (since they earn fees from them), which means every market has a built-in growth loop of users sharing it with others who care about that topic. This could lead to truly organic viral growth, as communities rally around markets that matter to them.

We are not limited to what a corporate team thinks will generate volume. Instead, we can tap into the wisdom (and curiosity) of the crowds. The result is a far richer, more diverse set of markets, from global politics to local sports and macroeconomic indicators to pop culture events, all reflecting the interests of the user base itself.

This bottom up content approach not only increases engagement, it also reinforces that Aura is a marketplace owned by its community. It's the YouTube of prediction markets, where users create the content, rather than a cable channel with a fixed programming schedule.

Built on Alephium for Performance

A common critique of fully decentralized apps is that they sacrifice speed and cost efficiency.

Early blockchain prediction markets like Augur suffered from high fees and slow transactions on Ethereum. We tackled this head-on by building Aura on Alephium, a high-throughput, sharded Layer-1 blockchain known for low fees and scalability. Alephium’s design lets us support high frequency trades, complex markets and a large number of simultaneous markets without the prohibitive gas costs that plagued earlier protocols.

The choice of Alephium means that on Aura, placing a trade or opening a market is fast and costs pennies, not dozens of dollars in gas. This is critical for making the user experience smooth and accessible. Traders can arbitrage and react in real time, and even small stakes users can participate without fees eating into their potential profits.

Scalability at the base layer ensures that decentralization does not come at the cost of performance. In fact, we aim to surpass the throughput of any centralized platform by leveraging blockchain efficiency improvements. By marrying decentralization with real performance, Aura disproves the notion that you must choose one or the other.

Fixing UX: Gas Abstraction, Stablecoins and Seamless Onboarding

One of the lessons from the early days of decentralized prediction markets is that user experience matters. If using a platform feels like a chore, whether its constant MetaMask pop ups, managing volatile crypto, or struggling with private keys, mainstream users simply won't show up.

Aura approaches UX with the same priority as a Web2 startup, while keeping things non-custodial under the hood. For example, users trade in stablecoins (like USDT) on Aura, so you’re always betting and winning in a familiar unit of account, not a token prone to wild price swings. The gas fees on Alephium are minimal and will be handled behind the scenes, so you don’t need to hold the native ALPH token or micromanage gas for each action.

Aura’s smart contracts and relayers abstract away the blockchain complexity, so you can focus on the markets, not the mechanics. We will also implement passkey logins (WebAuthn) for account creation and security. This means new users can sign up with a fingerprint or face ID, no browser extensions or seed phrases required. From a user’s perspective, logging into Aura feels as easy as logging into a modern app, yet behind the scenes they’re actually getting a non-custodial wallet that they alone control.

By eliminating the traditional frictions of Web3, we ensure that decentralization doesn't come at the expense of usability. In short, we marry the slick UX of centralized platforms with the self-sovereignty and openness of crypto.

Through this combination of technical and economic design, Aura presents a blueprint for the next era of prediction markets. Decentralized, trustless, and community owned, without compromising on liquidity or user experience. We believe this model addresses the core issues of the centralized approach and sets the stage for sustainable, inclusive growth of the ecosystem.

A Shared Stake in the Future - Join the Movement

Stepping back, it’s worth reflecting on why all of this matters, beyond just profit and technology.

We are living in a time when prediction is becoming the defining lens of our era, from forecasting elections and pandemics to speculating on economic shifts or cultural trends. Society is increasingly focused on anticipating what comes next. Prediction markets are a manifestation of that cultural shift, as they turn collective opinion into quantifiable odds, and in doing so, they produce a real-time signal of what we, as a society, think about the future.

In an age of information overload and uncertainty, that signal is incredibly valuable. It’s not just about gambling or finance, it’s about contributing to a shared body of knowledge. When you trade on a prediction market, you’re essentially saying “I have information or intuition about this event, and I’m willing to stake something on it.”

Aggregated across thousands of people, those stakes produce a probabilistic insight that anyone can observe. In this way, prediction markets allow everyone to have a stake in the future, not just literally (by investing in outcomes), but figuratively (by participating in the formation of our collective expectations).

This is why decentralization is so important. If prediction markets are to become a foundational tool for how society discerns truth and forecasts what’s coming, they must belong to everyone, not just a privileged few. An open network like Aura means that students in Bulgaria, farmers in Iowa and analysts in London all have equal access to trade on information that matters to them. It means that the next great market question might be invested by a school teacher or a sports fan, not just a corporate product team. It means the fees generated by this “wisdom of the crowd” flow back to that crowd, incentivizing more participation and better information over time.

Ultimately, a decentralized prediction market is a way to align incentives around discovering the truth. When people have skin in the game, they tend to be more honest, more engaged, and more forward looking. In that sense, prediction markets are a cultural innovation as much as a financial one. They encourage us to think critically about the future and reward us for being right, or teach us when we’re wrong.

2025 proved the immense potential of prediction markets. Now the challenge and opportunity of 2026 and beyond is to reshape that success in a decentralized mold. We don’t have to accept the future where this powerful tool is controlled by corporations and regulators alone. Instead, we can build a future where prediction markets are a public good, an open protocol that the world can trust and build upon, much like the internet or open source software.

Final Thoughts

At Aura, we’re turning this vision into a reality, but we can’t do it alone. This is a call to action for everyone who believes in the promise of Web3 and the power of collective intelligence. Join us.

Whether you’re a seasoned trader, a developer, or just someone passionate about the future, your perspective is needed in our community. Come participate in Aura’s open testnet, help us refine the product, and become an early member of a movement to democratize prediction markets and decentralize the truth. Together, we can ensure that the next chapter of this industry isn’t just about volume and valuations, but ownership, fairness, and a shared stake in the future.

The boom has shown what’s possible. Now let’s build what’s sustainable.

Join Aura’s testnet and community to be part of the prediction market revolution, the way it was always meant to be.

Follow us: @AuraMarkets Follow me: @HaydenAlph Docs: AuraDocs.Gitbook.io Join our TG: https://t.me/AuraMarkets

![Decentralizing the Future: Aura’s Community First Vision [Part 2]](/static/6cb6b6675e3c085143d237ca0454632a/66634/article-permisioned-l1-5-.png)

![After the Boom: Why 2025’s Prediction Market Surge Demands Decentralization [Part 1]](/static/dc61b936d9e09ff526cf87eb22861836/47126/article-permisioned-l1-3-.png)